Student Loan Forgiveness is Not the Issue

Today, student loan forgiveness is a political hot-button topic. Wade into the morass of comments on articles like this one if you don't believe me.

But that’s not the actual issue. Student loans aren’t the root cause of the economic malaise in which many young people are ensnared.

Rather, student loans are a symptom.

So what is the core issue, then?

Fairness.

Specifically, fairness as it relates to social mobility.

I’ll explain:

As the Economic Policy Institute explains, worker compensation closely tracked productivity growth nationwide from 1948-1979. But from 1979 through 2021, workers on average continued to improve their productivity. But wages, adjusted for inflation, have not kept pace:

Chart source: https://www.epi.org/productivity-pay-gap/

Over time, inflation-adjusted wages have been fairly stagnant. In fact, in inflation-adjusted terms, they actually decreased from 1979 until about 1997, when adjusted for inflation!

(Take note, Baby Boomers – the figures on the chart below are expressed in 2021 dollars. Nobody’s saying you earned $15.00 per hour when you were bussing tables in 1979...)Chart source: https://www.statista.com/statistics/185369/median-hourly-earnings-of-wage-and-salary-workers/For more reading on this particular topic, see this Pew Research article from 2018. From that article: “In fact, in real [that is, inflation-adjusted] terms average hourly earnings peaked more than 45 years ago. The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.”

Wealth inequality over time has similarly increased. Where do you think the money was going from all those productivity gains?

Again, Pew Research weighs in, this time from an article published in January of 2020: “If…incomes had continued to increase in this century at the same rate as from 1970 to 2000, the current median household income would be about $87,000, considerably higher than its actual level of $74,600.”

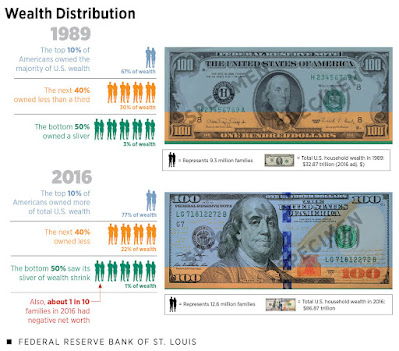

The St. Louis Fed issued a report on wealth inequality in 2019, noting the differences from 1989 to 2016:

The gap between CEO pay and average worker pay, measured over time, is shocking! The Economic Policy Institute issued a pretty comprehensive report in 2019:

- As the graphic above shows, there are two ways to count executive compensation: based on options granted (meaning stock options granted in theory), or based on options realized (that is, the stock options that CEOs actually exercised). It seems to me that options realized is the fairer measure for this comparison, though I could see a compelling case for both sides.

The CEO-to-worker ratio was 24.5 in 1979 (if you use the typically-lower 'options granted' approach) or 31.6 (if you use the typically higher 'options realized' approach). Still higher than the ~20-to-1 ratio measured in 1965, but not excessively so.

The gap continued to grow at a fairly steady pace to a ratio of almost 60-to-1 by 1989. But, by 2000, the gap had exploded to heights that would make Rockefeller blush! The peak CEO-to-worker gap reached a whopping high of 368-to-1 (if you continue to use the 'options realized' approach).

By 2018, the latest data in the set presented here, the gap settled down to a 'mere' 278-to-1 ratio. And you can see from the chart that the most rapid growth coincided with the tech bubble from about 1995 to 2000. People are often shocked to learn that the top marginal income tax rate was as high as an astounding 94% in 1944 and 1945! That percentage remained in the 80s or 90s for every year from 1940 through 1963.

No, in case you're wondering, that does NOT mean the government took 94 cents from every dollar that people earned. That rate only applied to every dollar earned above a certain, very high threshold ($200,000 per year back then, equivalent to over $2.8 million a year in 2018 dollars). So you had to have an exceedingly large income to qualify for the top tax rate, and then that rate would be applied only to whatever portion of your earnings exceeds the threshold.

According to the argument I read (Senate testimony from an economics professor), the point was not to collect more revenue for the federal government (though it did contribute at least a little bit to the federal coffers). The point was to discourage excessively high rates of pay and thereby reduce income inequality.

Because, in the end, it's bad for social stability to have the types of extreme pay disparities we've seen in recent years.

Like 278-to-1.

So a very high top marginal tax rate actually serves as a limit on extremely high compensation. Or at least produce other, more roundabout forms like stock grants and stock options. This policy ultimately contributes to the desired effect of a society that lives in greater harmony.

Does that mean the top rate should be 80 or 90 percent? No, I think that's probably excessive. But still, it would make sense to pick some stratospheric number - say, $20 million per year in income - and say, anything above that gets taxed at 70%.

The end result of this is essentially that pay will get capped at $19.99 million per year, because nobody will want to pay 70% in taxes. I still think that's a ridiculously high number anyway, because I could retire on less than one-tenth of that figure. And that compensation is for only a single year!

Nobody needs compensation that high. Nobody.

I think the Warren Buffett executive compensation plan is a wise one - a solid but not excessive salary (his compensation of $100k is pretty low these days; I think $1-2 million would be fine even for CEOs of large corporations), along with a couple reasonable perqs (like security) and a decent chunk of stock that doesn't fully vest for at least 5-7 years.

This would essentially force executives to think long-term. If prospective executives don't like it, they're probably spendthrifts who are just looking to rob the organization anyway. Let 'em go ruin another company instead. And if all companies did this, maybe C-suites wouldn't have so many shortsighted, incompetent buffoons.

About 15 years ago, I remember first hearing that the costs of higher education and healthcare have been rising much faster than general inflation. Here's a link on that. [But see the Cato Institute's argument that they should be compared to services, not general consumer-goods. Fair point, but the rate of inflation for higher ed and healthcare are still higher than services in general. They're just not quite as much higher.]

As Lyn Alden observed back in 2019, the US federal government's financial health over time has been getting worse. And that was before they gave away all that stimulus money due to the COVID shutdowns!

An increasing debt-to-GDP ratio is an ominous sign. An aging population with low birth rates and restricted immigration leads to no apparent way out of that debt trap. Even though the US is in better demographic shape than Europe and Japan, it's still not a good long-term outlook.Tax policy in the U.S. today, compared to tax policy decades ago, is far more burdensome on the lower and middle classes than on the wealthy.

But 50 or 100 times? 278 times?! 368 times?!

Clearly, the typical worker's increasing productivity simply goes to pay for company perqs, including humongous pay packages, for the executive team. Meanwhile, the purchasing power of that typical worker's wages hasn't really changed in 40 years!

You wonder why there's so much rage and despair among people 40-and-under today? It's not because they're spoiled, or because they have iPhones, or because they're busy spending their mortgage payments on avocado toast.

It's because the fruits of their labor are being robbed by the top 0.01 percent.

Mega-rich CEOs are the new kings. They confiscate the wealth of the people and accumulate it for themselves, while refusing to toss more than the merest crumbs to the commoners on whose backs they tread.

Of course, nations are much larger today. The majority are not run by monarchs (though of course some monarchies do remain, even in 2023). But the power and wealth enjoyed by people at the very top of even free societies today rivals that of kings and emperors of old.

But history gives us some bloody examples of what happens when monarchs get too greedy. Of what happens when they fail to manage the inequality that naturally builds over time.

I doubt that humanity will ever eliminate inequality. In fact, I don't think we should. Extraordinary skills, effort, and/or productivity should justly be rewarded with above-average compensation.

A limited amount of inequality is acceptable; stray too far beyond those bounds, and snick goes the guillotine! As the saying goes, moderation in all things (perhaps except moderation itself).

So, let's sum up:

- Wages haven't kept up with the pace of inflation since about 1980;

- In inflation-adjusted terms, the cost of education (and healthcare) have been going up even faster than most other prices;

- Corporate executives appear to be the main beneficiaries of current arrangements.

- Most people are not corporate executives.

It should now be apparent that student loans are not the core issue. Fairness is the core issue. People perceive, to borrow a phrase, that 'the rich are getting richer, unfairly.'

It's one thing to get richer from being good stewards of one's resources (which is the kind of thing advocated around here!). But it's another to get richer by driving up employee productivity, without sharing any of those gains with the people who do the actual production.

Does that approach strike you as fair?

The problem is, in essence, rent-seeking behavior (in other words, parasitism) by corporate executives and others, who then turn around and flaunt ill-gotten wealth at a level that most people can't imagine!

It's Jamie Dimon getting paid over $30 million per year while overseeing a bank that habitually violates regulations and pays massive fines. And it's the lack of spine from regulators and 'leaders' in government who permit and endorse such behavior. (And who sometimes even engage in news-making reports of unethical behavior themselves.)

If we can fix this root cause, the student-loan issue will cease to be an issue for most graduates.

Partial annotated bibliography (aka thoughts on some of the sources):

This might sound like some sort of leftist rant, but it isn't and I'm not. Sometimes, I agree with Republicans; other times, with Democrats. I go issue-by-issue and try to follow the data, which seems to me the only rational way to decide on policy positions.

An issue this important, this integral to the functioning of a just society, shouldn't be confined to a certain political party. So here are some thoughts on the sources in this article.

https://www.epi.org/publication/ceo-compensation-2018/

and

https://www.epi.org/productivity-pay-gap/

As far as I can tell, EPI is non-partisan but it appears to lean pretty clearly to the left. Nonetheless, I don't believe either Democrats or Republicans have a monopoly on truth. Their papers seem to be based on legitimate facts, as far as I can tell.

You may or may not agree with the EPI's specific policy recommendations. But the problem is serious and needs to be addressed, whatever solutions you may devise or support.

If you don't believe the EPI, how about Pew Research? That is definitely a non-partisan organization, and their website states that they do not take policy positions.

Pew Research [actually, if you want to get technical, the Pew Charitable Trusts] was originally established by the conservative-leaning Pew family, descendants of the founder of Sunoco. And this Pew article says the same thing as EPI about the productivity-pay gap, so this is obviously a well-established issue and not just some leftist scare-mongering tactic.

https://www.cato.org/blog/compare-medical-college-inflation-services-not-goods

Speaking of politics, the Cato Institute leans to the right, and even they have to admit that the costs of college and healthcare are rising faster than other services (let alone physical goods like groceries).

This guy may be an economist, but I strongly disagree with him on the 'wealth tax' part of his testimony. That would merely create an incentive to spend and to avoid building wealth. That is NOT a good policy for any country. Plus, the extremely wealthy will just move to Monaco or wherever and flip the IRS the bird on the way out.

Such a plan would also require ridiculous amounts of bureaucracy - somebody's got to estimate the values of illiquid assets - as well as clogging up the courts with lawsuits to contest the estimates. Do you really think the wealthy are just going to sit still and let the government confiscate their wealth?

Moreover, it would require people to sell pieces of their businesses in order to gain the liquidity to pay the tax. Which means this policy would force them to surrender equity in their own business, eventually surrendering control, just to pay this tax. That'll be just wonderful for proprietors of small businesses.

Stupid, shortsighted idea, but it seems pretty popular on Capitol Hill. What does that say about Capitol Hill?...

Infuriating. Break 'em up. Break 'em ALL up. Where's Teddy Roosevelt, the Trust Buster, when you need him?

https://www.thedailybeast.com/sen-kelly-loeffler-dumped-millions-in-stock-after-coronavirus-briefing

Remember when this one hit the news? And then, instead of going to prison for insider trading, she ran for Senate again?! Yeah, good times...

Kinda boring, but hey, taxes prompted the American Revolution, so I guess it's a pretty important topic, no?

Plus, a whole lot of people don't actually seem to understand how marginal tax rates work. This link can help to explain it.

Speaking of inflation, it's usually defined in a deceptive way. Even Wikipedia defines inflation as "in increase in the general price level of goods and services in an economy."

But what it really is, at least as defined by monetarists like Milton Friedman, is a decline in the value of currency.

If, for example, Zimbabwe is facing hyperinflation, such that a bus ride costs more in the evening than it does in the morning, and it takes Z$10 billion to buy a loaf of bread, that sure makes it look like prices are rising. Right?

https://www.joshuakennon.com/the-top-14-federal-income-tax-payers-of-1924/But if prices remain the same when they're denoted in another currency, like the U.S. dollar or South African rand, are prices really going up? Or is it that people have decided they don't want the Zimbabwe dollar?

It was easier to understand this in the old days, when coins were made of precious metals. If a new silver coin weighed less than last year, then it was worth less because the new coin contains less silver. Or if the government collected old silver coins with a 92.5% silver content, melted them down, and re-issued them with only 85% silver, then it was worth less because it contains less silver.

I really like the way he explains things, and it strikes me that he has not just knowledge but wisdom. Allow me to quote from the end of the article, written in 2012: "as a society, we allocate our capital to bombs and missiles instead of books and space stations...This is not a rational way to run a civilization.

I worry that we are facing a lost generation; that the 18-to-22 year old crowd right now is getting the short-end of a generational theft that is so massive it is almost incomprehensible. At the same time, I know there will be exceptions...Still, that isn’t good for democracy to have so many people unable to form families and get ahead."

Seriously. A base salary of $1.5 million is reasonable, but $33 million in incentive pay ($5 million in cash bonus and $28 million in stock) is absurd.

That level of compensation would even be ridiculous if JP Morgan Chase was a law-abiding organization that didn't continually pay fines for violating the law.

The costs of those fines are, of course, ultimately borne by shareholders. Not by the executives who are supposed to be overseeing operations, nor by the board of directors, who are supposed to be overseeing the executives. No, those fines eat into company profitability, which means smaller dividends for shareholders.

But that doesn't stop Jamie Dimon from getting paid over $30 million in total compensation every year!

.JPG)

.JPG)

.png)

No comments:

Post a Comment